DeFi development services

- What is DeFi development?

- What is a DeFi service?

- DeFi Smart Contract Development

- DeFi Dapp Development

- Decentralized Exchange Development

- DeFi Landing/Borrowing Platform Development

- DeFi Wallet Development

- DeFi Staking Platform Development

- DeFi Crypto Banking Development

- DeFi Development Services

- Where can I find DeFi developers?

Decentralized finance, or DeFi for short, is a technology-based blockchain network, banking services in your pocket without a controlling authority, where you are your banking institution.

The attraction of DeFi lies in personal data security, in the transparency of the process due to the code being open to all, high-interest rates, and the absence of intermediaries. Moreover, the idea seemed so tempting to investors that, as of January 2022, about 92.3 billion dollars have rotated in decentralized finance.

Despite such a considerable amount, the market is still far from oversaturation; moreover, it is beginning its journey. So, if you are planning to get into DeFi development you will definitely not jump on the last step of this locomotive. Still ahead! That is why it is so important to navigate the DeFi development service market to seek services from a trustworthy company.

What is DeFi development?

DeFi development is a complex process that is somewhat different from classical development due to the specifics of the Web3 area. It has many branches, features, and complexities. Thus, it is impossible to be an expert in absolutely everything. Each development team must be sharpened for a specific set of solutions to achieve the ideal result. Accordingly, hiring a huge staff of people, adapting them, giving them time to work together (and all this for the sake of one project) does not make sense. It is better to outsource professionals who do not have a successful project behind them.

What Is DeFi? The Basics Of Decentralized Finance

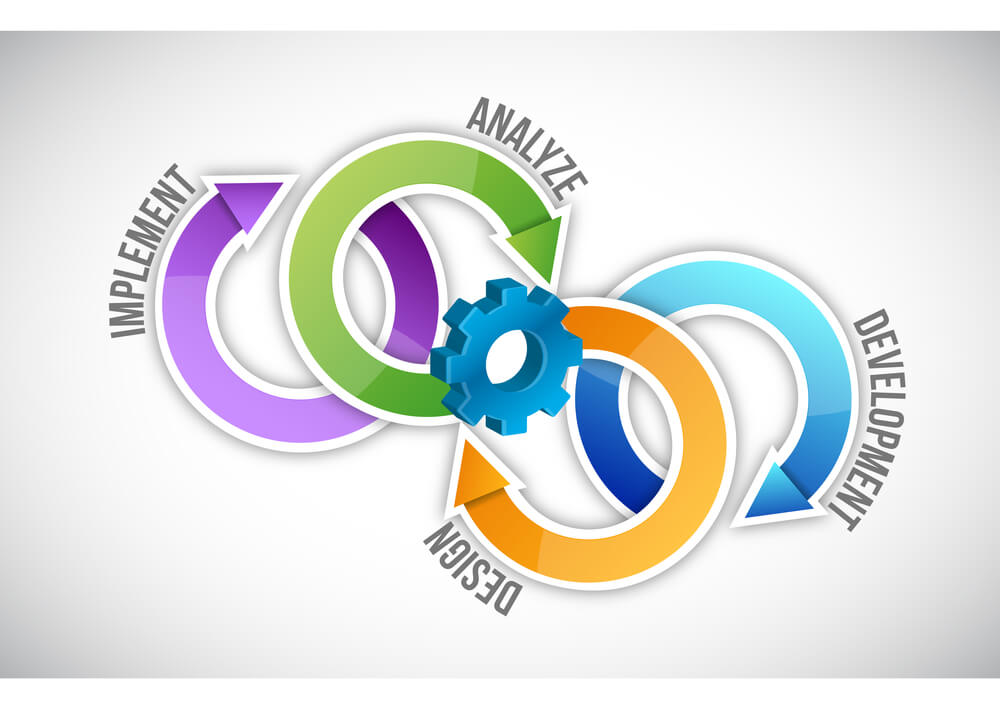

The general DeFi development mechanism looks something like this…

As with any software, we first need to decide what we build. Who is our target audience? What are their needs? Then you need to prioritize features under ROI expectations correctly.

Design should be considered when developing DeFi scalability. The user interface must remain flexible enough to support additional features that will be added to the application over time. In general, not all applications for Web3 now look as attractive as they could. Presently, this step is a weak link that needs to be eliminated.

More often than not, it’s best to work agile at the moment, as flexibility is critical, especially in crypto and blockchain projects where so many things come up every month.

Maintaining the protocol means releasing updates with new features and fixing bugs. However, if the front end can be easily updated without problems, how do we update the back end in the blockchain system? To do this, you need to continue cooperating with the team involved in the development.

What is a DeFi Service?

Let’s talk in more detail about the services whose development is most promising at the moment.

How To Make A Personal Finance App

Smart contacts in the field of DeFi are a vital technology that needs to be developed with the utmost seriousness. Literate programming solves many problems, including accuracy, speed, scalability, reliability, security, transparency, easy exchange and access, and much more.

What Is A Dapp? Understanding Decentralized Applications

Decentralized applications are taking over more and more areas from the NFT market to gaming, from Communication to Healthcare. But by far, most dApps exist in the decentralized finance space. As of 2021, investments in the market amounted to $40 million. Of course, such popularity is associated with a good level of privacy and the complexity of hacking. However, as practice shows, “craftsmen” are still there. This suggests that there is no limit to perfection, and whoever creates an almost perfect application in terms of security will quickly earn popularity.

In addition, at the moment, due to the relatively small number of users who use dApps, UI/UX design issues are not at the highest level compared to the apps we are used to. So in this regard, too, there is room for improvement.

How Does Blockchain Amplify Adtech Industry

A decentralized currency exchange (DEX) is a promising project due to the absence of intermediaries. DEX allows blockchain, a distributed ledger, to act as a third party. The underlying cryptocurrency technology eliminates single points of failure by moving critical transactions to the blockchain, allowing consumers to retain ownership of their assets and enabling more secure and transparent trading. The DEX uses smart contracts to execute market transactions by distributing transactions across an offline code. However, order fulfillment methods with varying degrees of decentralization are available.

Accordingly, it is very promising to work on developing such projects. However, do not forget that a crypto exchange is a complex system that cannot be created without knowledge of the matter. Therefore, a comprehensive study is needed.

Building a DeFi lending site, followed by native mobile apps once you get real support, is an ingenious strategy, as long as the site scales appropriately for the web and mobile platforms. Keep in mind the powers of the agile methodology, crucial to the project’s success: flexibility, transparency, and speed.

DeFi Wallet differs from the usual in its technological features, where it is not a centralized financial institution that is responsible for the safety of funds but smart contracts. And to create secure and functional smart contracts, good experience with the blockchain is required.

What You’re Paying For Or How Ads.Txt Helps To Fight Adtech Fraud

As a rule, DeFi wallet should include the following options:

- DUO

- Face/Touch ID

- Multi-signature

- Session logout

DeFi Staking is the storage of funds in a cryptocurrency wallet to ensure the support of all transactions on the blockchain. The more favorable reward terms you offer, the more likely users will deposit their assets into your platform’s liquidity pools. Therefore, the more liquidity a platform provides, the more reliable it looks in users’ eyes. In addition, by delivering staking opportunities, your platform will be able to earn more from transaction fees as there will be more transactions.

The emergence of new staking models and improved staking platforms allows this type of passive income on crypto-assets to attract more and more investors. No wonder the development of the DeFi staking platform is booming.

An attractive idea could be to create your own crypto-bank that works with the help of smart contracts. Thus, any crypto-assets operations become more secure and confidential, and no one will check the credit history. This always attracts a large number of cryptocurrency holders. Therefore, the complex development of such a decentralized financial institution can bring substantial income relatively quickly. The main thing is not to spare investments to turn out to be of high quality.

What Is The Difference Between Web 2.0 Vs. Web 3.0?

This is not the entire list of services somehow related to blockchain technology. The more opportunities open up in the Web3 dimension, the greater the range of DeFi development services becomes, which already penetrates all spheres of our lives.

Where can I find DeFi Developers?

Since DeFi and the Web3 niche, in general, are only at the beginning of the journey, finding the right company to implement your project as you see it is not so easy. Of course, now hundreds, if not thousands, of outsourcing companies worldwide offer DeFi development services in the field of decentralized fintech, but if you compare them with the number of developers of traditional Web2 software, then there are not so many of them. And the quality of services can also be questionable.

However, hiring a whole pool of developers with specific knowledge and skills can also be costly. Therefore, the best solution is still seen as hiring an outsourcing company that will fulfill all your wishes and even offer the best alternatives where required. We can become a DeFi development company for you – The APP Solutions.

Credits to Depositphotos