A Guide to Crypto Wallet Development

- What is a Crypto Wallet?

- How do Crypto Wallets Work?

- Types of Crypto Wallet

- What is Crypto Wallet Development?

- How do I Make a Crypto Wallet?

- Cryptocurrency Wallet Development

- Guide for Crypto Wallet App Development in 2022

- Key Features of a Crypto Wallet App

- And Again, about Security in Cryptocurrency Wallet App Development

- Output

Almost no one doubts that cryptocurrencies have settled in the global financial space profoundly and permanently. Consequently, a kind of accompanying products that successfully expand this ecosystem is being created to make it easier to use. If there is currency, it means that it must be stored somewhere. That’s how the crypto wallet came about, allowing users to perform cryptocurrency transactions – quickly and securely.

However, no technology can gain enough popularity and spread if it’s too complicated to use. That’s why the decision to create apps for crypto wallets has become quite successful and proven to be practical. In this article, we will explain what crypto wallets are, how they are created, and what you should pay attention to when developing their applications.

What is a Crypto Wallet?

Crypto Wallet is an app that transfers digital transactions or cryptocurrencies between participants in a specific blockchain network and triggers blockchain smart contracts. Its storage functions are the same as those of an e-wallet but apply to cryptocurrencies. It is a piece of software that securely stores cryptocurrencies and keeps track of their transaction records (buying, selling, and crediting). The wallet also serves as an identifier and blockchain account.

A cryptocurrency wallet can be installed on a smartphone, making it as easy as possible. You can store it on your laptop, any browser, or even… in your pocket.

Wallets eliminate intermediaries in transactions. This allows customers to conduct instant operations. With a cryptocurrency wallet, transaction fees are significantly reduced or even disappear. As a consequence, user satisfaction and the intensity of their exchanges increase.

WHAT IS WEB 3.0? INTERNET NEXT ERA BASED ON BLOCKCHAIN

How do Crypto Wallets Work?

A crypto wallet makes transactions by a combination of a public and a private key. The public key is, in fact, your wallet address (roughly speaking, an analog of a bank account.) You can share this address with a financial institution or another counterpart (an individual) without fear. If we continue to appeal to the analogy of the banking system, the private key is something like a pin code to your debit card, that is, the password to the public key.

For your wallet to receive money from the sender, you have to give the recipient a public key – the crypto wallet address. Cryptocurrency is not stored directly in your digital wallet – it stays in the blockchain. Since cryptocurrency has no physical expression, your crypto wallet contains not money but a piece of coded information. And even if you keep a crypto wallet in your hand, the money itself won’t actually reside there. What is it then? Let’s talk about it right now.

HOW TO MAKE A PERSONAL FINANCE APP

Types of Crypto Wallet

Just like the usual electronic wallets, crypto wallets are divided into variations; depending on the needs of the holder, they are customized.

A Cold Wallet is a hardware wallet. This variation is suitable for cryptocurrency holders who view it as a long-lived active and do not intend to use it in the near future. Basically, cold wallets are something like flash drives or even paper wallets (sometimes it is considered a separate type) with printed public and private key information on paper. Sounds a bit strange, doesn’t it? However, crypto-holders have more confidence in this type of storage because it is impossible to “hack” a physical wallet (although you are not secured from “good old” theft or a trivial loss in this case, if you did not take the appropriate measures first).

A Hot Wallet – software-based wallet. This variant is best suited for eager crypto-traders who make transactions almost daily or several times a day. Accordingly, such cryptocurrency wallets are less protected. Hot wallets are divided into subspecies, depending on where they are stored:

- Desktop Wallets

- Mobile Wallets

- Web/Online Wallets

Each of these subspecies has its unique advantages. For example, a desktop wallet is stored on your computer or laptop. This type is pretty safe (except for viruses) but also has some drawbacks (you can’t drag your laptop everywhere.) Examples – Bitcoin Core, Bitcoin Knots, MultiBit, Armory, and Electrum.

Mobile wallets are anonymous, encrypted, inexpensive, and decentralized. Examples are Bitcoin Wallet and Hive Android. In addition, Crypto wallets of this type are the user-friendliest, so they are often downloaded. Thus, 62% of all blockchain storage is for mobile blockchain wallets.

Web wallets facilitate crypto access from any browser, mobile device, etc. They work in the cloud. They are very convenient to use because private keys are stored online. However, sometimes they become vulnerable to hacker attacks because a third party indirectly controls them.

What You’re Paying For Or How Ads.Txt Helps To Fight Adtech Fraud

What is Crypto Wallet Development?

Cryptocurrencies have already proven their resilience. Many financial analysts thought it was a modern trend that would pass quickly, but this did not happen. Instead, Bitcoin emerged back in 2009 and is doing very well. And it has about 18 thousand competitors, both serious and not so serious.

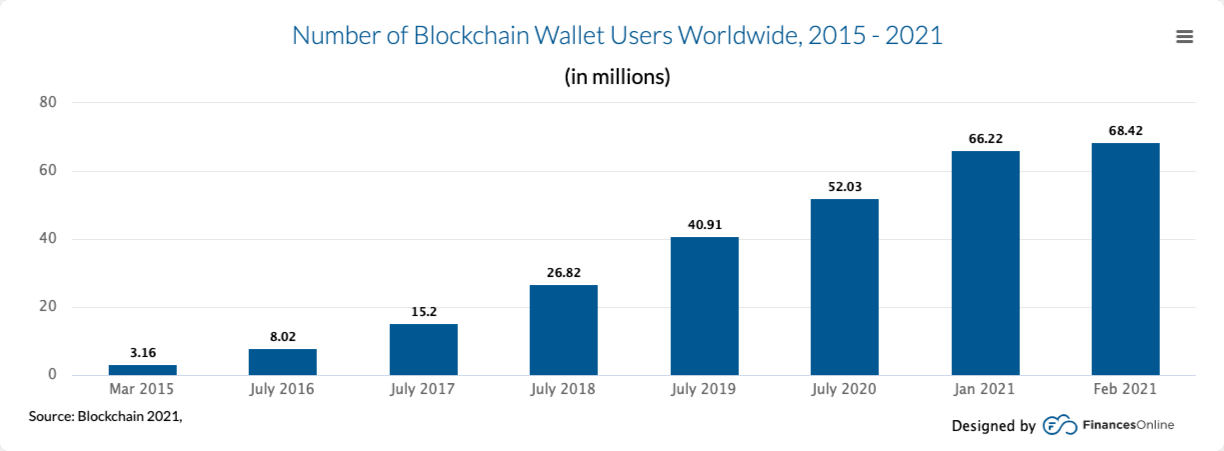

According to Statista, the number of crypto wallets has been growing steadily since 2011. And while at the end of 2016, there were about 11 million, from January 2021 to January 2022 alone, the number grew from 66 million to 81 million.

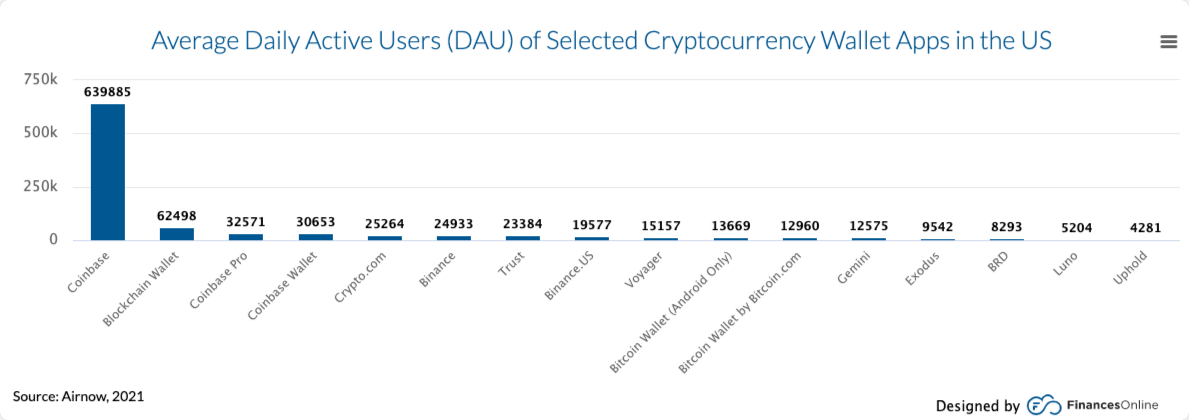

In total, there are more than 80 wallets in the world. Thus, Ledger Nano S (hardware platform) wallet supported 472 digital currencies. The top most popular crypto wallets now look like this:

Some of them support several hundred cryptocurrencies, and some – several dozen. Therefore, whether it makes sense to engage in crypto wallet development falls away by itself. By the number of cryptocurrencies and wallets, it is obvious that the market is not yet oversaturated. In addition, more and more businesses are deciding to get personal cryptocurrency wallets, integrating them with payment and other business solutions.

In the first half of 2021, Coinbase had a total revenue of $4 billion. That includes everything from cryptocurrency transactions to wallets. Even a Visa cryptocurrency card is available.

How do I Make a Crypto Wallet?

Most cryptocurrencies, such as Bitcoin or Ethereum, provide their own cryptocurrency wallet, except integration for a trader who wants to invest in multiple cryptocurrencies . Of course, these cryptocurrency wallets are easy to integrate and use for simple tasks. Still, it is also possible to develop your crypto wallet app to implement more complex business logic or functionality.

You can hire The APP Solutions to create a crypto wallet or develop a cryptocurrency wallet application, or an entire digital ecosystem that includes not only crypto assets but also integrated stock buying capabilities, as well as other features inherent to neobank.

Cryptocurrency Wallet Development

It cannot be said that the process of developing crypto wallets is some kind of unique task. Any product needs precise planning, which should be divided into stages.

WHAT IS A DAPP? UNDERSTANDING DECENTRALIZED APPLICATIONS

Creating a custom wallet has a clear goal, from which further functionality should be guided. Before starting to work, you need to understand the team composition which will deal with the development within a clearly defined time frame, no matter what method of managing processes is used in the team.

According to the needs and the outlined team and timing, a budget is formed, which, moreover, still needs to be properly split into stages. Furthermore, you need to have an additional financial safety cushion, that you can access if necessary, because at any stage there may be various ideas and, as a result, unforeseen costs. Therefore, the MVP is first created, on which additional features are “strung.”

Any cool idea requires an equally cool visualization. A crypto wallet, packed with useful features, will never become popular if its interface is too complicated for a broad audience and risks remaining a limited niche product for specialists. Although, we do not exclude that your target audience can be the latter, they would also like to see a usable product.

Once the business and technical characteristics of the wallet are understood, the architecture of the wallet application is built and agreed upon with clients. This step defines the communication between the frontend and backend of the wallet, how the wallet is created, how data is stored and retrieved, and how transactions are conducted. The architecture serves as a template for all subsequent stages of development where the backend will provide the link between the frontend and smart contracts.

Some clients prefer to skimp on the part that you can’t avoid. So at this stage, the team eliminates all bugs and glitches found in the application.

The stage where the crypto wallet goes out into the world. The first downloads and natural user experience will show how well the product is built and what can be fixed as quickly as possible.

Crypto wallets are a technology that requires constant support and updates, both for security and to improve existing features. What Is DeFi? The Basics Of Decentralized Finance

Guide for Crypto Wallet App Development in 2022

After we have discussed the stages of creating the crypto wallet itself, we should mention the mandatory set of features typical for any such application, emphasizing usability and security. Even the brightest and most promising idea of mobile wallet development can fail without understanding blockchain and cloud technologies, without using APIs and standard open-source cryptocurrency libraries and, finally, without correctly matching the technology stack to your specific case.

HOW DOES BLOCKCHAIN AMPLIFY ADTECH INDUSTRY

- Authorization (an indispensable part for the vast majority of applications, and financial applications, it is also a matter of reliability).

- Session duration (for security purposes, it’s important for any financial app).

- QR Code Scanner (increases speed, convenience, simplicity, and security of transactions in the app, due to automatic scanning of wallet addresses and public keys).

- Multicurrency (if your application is not aimed at specific crypto, you’d better add an option to work with several currencies, including fiat, this will significantly expand your target audience).

- Integrity (another advantage of your app may be importing a mobile wallet into a more secure paper wallet with the same QR Code).

- Push Notifications (messages that notify the user of transaction statuses, exchange rate fluctuations, conversion rate changes, etc.)

- Commissions (crypto wallet apps should be able to constantly calculate floating commissions).

- Blockchain (all completed transactions are transferred to the blockchain network and stored there).

WHAT IS AN NFT? NON-FUNGIBLE TOKENS EXPLAINED

It is commonly believed that blockchain, due to its “crushed” nature, is a much more secure technology than any other from the web 2.0 group. However, blockchain itself doesn’t guarantee that your wallet will be anti-cracked, so there are several securitization aspects that a developer should worry about:

- Two-factor authentication or, better yet, multi-factor authentication, with a unique pin code or biometric data as the second factor.

- Wallet backup, which must be stored in several different places.

- Suppose a company uses a cryptocurrency wallet profile for business purposes and has several authorized users. In this case, each of them will be able to dispose of the cryptocurrency only after everyone else gives their permission.

- Security updates are the most important element of the ongoing cooperation between the customer and the development team. Since hacking technologies do not stand still, one cannot develop a particular set of security services and just stop there.

HOW TO INTEGRATE PAYMENT SYSTEM INTO THE EXISTING APP

Output

Like any financial product, a crypto wallet is a complex technology that requires the maximum involvement of professionals with experience, from developers and testers to business analysts and marketers.

Most crypto products that fail rarely get a second chance, at least under the same brand. Find a capable crypto wallet development team that understands user-centric design and blockchain technology in equal measure. At The APP Solutions, you will find understanding, competent people with whom you can indeed find common ground for further fruitful cooperation.

Credits to Depositphotos