Pros and Cons of Bootstrap and Investment Funding

Startups. Startups all around. Everybody is coming up with killer ideas and rush to find their target audiences to turn these concepts into beneficial businesses. As people become more and more open to new exciting experiences, a lot of projects really shoot up in quite a short term.

There always is another side of the coin, which is financing the whole venture. Here we come to an important decision because not everybody is able to support a business project independently.

Happily, nowadays freedom of communication and all these cosmopolitan trends in business present a lot more opportunities to young and creative people than back in the day. So in fact, you are not limited by only going to a bank and ask for a loan, you can find a lot of alternative funding options online.

Joining a startup accelerator, for instance, will ensure you not only with free office facilities or consulting services but also seed fund you. You can also barter your skills and this way get some service or facility for free or find an investor – angel or venture capitalist ones. You can even pre-sell your product before it’s actually done. Finally, you are able to apply to some business grants, which spring up like mushrooms overnight.

The objective of our today’s talk is two antipodal ways to fund your business:

- Bootstrapping – which is basically doing your best at crafting business with own resources;

- Investment funding – this is all about selling your idea to an investor, get your money, and give ownership equity to your creditor in return.

After reading the article, you’ll know exactly what do these financing methods mean and in what way they are different; what questions should be asked before committing to any of these models and which way can be more beneficial to pick.

First things first: explaining bootstrapping and investment funding

Bootstrapping

It’s essentially a way discovered by every entrepreneur at least once in their business journey. So anyone who’s started his or her business, tried to stretch any sort of available recourses as much as possible, right? And I don’t only mean startup thing, it can be a to-go strategy at various stages of business life.

The term bootstrapping comes from that very famous legend of Baron Münchhausen who pulled himself out of the water with the help of his own bootstraps.

The vital idea behind bootstrapping in commercial means is to borrow as minimal finance as possible. In two words, you only rely on either on your own budget and savings, on some crowdfunded amount, or simply on loans from friends and family. That’s totally the opposite of, for instance, selling your business idea to investors.

Bootstrap financing is also considered to be one of the most effective ways to assure a positive cash flow for your business and for a good reason. This scenario urges you to borrow insignificant amounts of money and this way keep interest costs minimal. You are turning your home into an office, follow a strict diet, and manage every penny of the budget narrowly for the sake of the flourishing future.

What does bootstrapping mean in business? In fact, this strategy doesn’t seem to be a huge trend internationally, but there is a list of really big brands, whose creators eventually bootstrapped them. And they nailed it.

I will just leave these names down below:

- Apple;

- Microsoft;

- Dell Computers;

- Hewlett-Packard;

- Coca-cola.

Investment funding

It is another alternative to arranging your business. And this strategy is different in all ways.

To make a long story short, this is a way to sell your idea to investors, who are interested in getting profit out of your one-of-a-kind idea in the future. So they finance your project for some ownership equity in return, evaluating closely the business potential beforehand. The most popular ones recently are an angel investing and venture capital investment funds.

Angel investors

These are usually wealthy businessmen, who are passing their funds onto well-selected businesses and promising start-ups. These guys are usually very cautious in making decisions because these are their private money. What’s more, angels also expect really high returns from their investments, as high as 15 to 30% of the company’s ownership. On the other hand, angel investors share not only funds but also knowledge, experience, and advice with us, fresh entrepreneurs. To get these guys’ attention, you should be well-prepared, competent, and have a thought-out strategy.

Venture capital investors

This option makes your contributors the decision-makers in a venture, not you. At the same time, getting under some high profile investor’s wing can give a rapid start and some extra credibility to your business. Without a doubt, they will also ask for the ownership equity of your company – that is a common scheme of such funding. You’ll also agree to various restrictions on your salary, cooperation with other companies, etc.

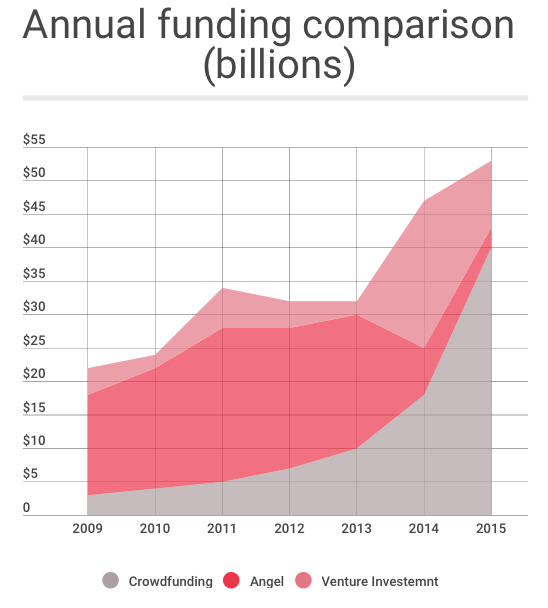

According to recent studies, the venture capital funding field is expanding and there is a growing number of start-up accelerators detected. The overall number of these funds also increases and stockholders become more and more open to smaller companies.

Described ways of financing your business are totally contrasting and offer various approaches to managing recourses and building overall commercial strategy. Both of them have proved to be realistic to implement. The decision is only on you – which one to pick. You are the creator of your success after all. Let’s just dive into the details and find out what details and questions should be considered before adopting any of these concepts.

4 major questions to ask yourself before picking a strategy

Apparently, you’ve already passed the stage of asking yourself a question “To be or not to be?”. Now it’s time to ask further, more complex, questions.

In the context of selecting one of the above-mentioned ways to go, let me outline and systematize topics for you to study in order to make a wise decision.

First and foremost: what is the focus of your [future] business?

If your ultimate priority is steady growth, then you better fix an investor’s support. With funders, it will be much easier to achieve. In this case, you want to clarify if the speed is important for you and in general throughout the market and if you’re able to keep up with it.

For example, if your startup is tech-oriented, here the tempo is quite high and it’s an inevitable part of the market. Technologies develop real quick and you have no chance but move with them, and even be a step ahead.

Otherwise, if you decide to concentrate on taking your product to a new quality level instead of spending time in meetings with investors, you should certainly try and bootstrap your biz. Besides, more money can solve a lot of problems and bring real decisions, but not always. For instance, if you’re limited on budget, you’re forced to make creative decisions and it will ultimately play into your hands.

Second important question: how much control do you want to have over your venture?

If that is one of the major principles for you, then cut off the idea of calling external funding in and look at bootstrapping or alternative self-funding schemes. You appear to be the only decision-maker and free to pivot from one corner of the market to an absolutely different one.

Unlike any venture investing scheme, which works approximately the same: you are expected to provide some ownership equity to your investor and they gonna rebuild your strategy and advise you what actions to take and decisions to make. In other words, many opinions are about to meet, a lot of meetings and discussions to handle.

Questions #3: what returns are you expecting from this enterprise?

Now we all know what does bootstrap means and obviously, you cannot expect some fixed income or salary to come to your pocket with this approach, right? Most of your cash flow from this project is going to be injected back into it – that is how companies with limited budgets develop and grow.

In the case of investors’ involvement, it’s easier. Even though a salary will be somehow limited at early stages and fixed in the contract, you are still guaranteed a monthly payment, which sounds secure, doesn’t it?

And last, but not least: what knowledge pool is required for growing your biz?

Are your skillset and knowledge base enough to craft a successful venture from the scratch?

What I mean is if your product or niche particulars require specific experience, knowledge, or access to any resources. And if you are able to fix it independently. Because investors bring in not only extra money, they own and share their widescale experience and professionals, who really know what they do and how to make things work the best they can.

Differently, if you rely on your own knowledge, connections, and potency, then it’s easier to go for the bootstrapping option.

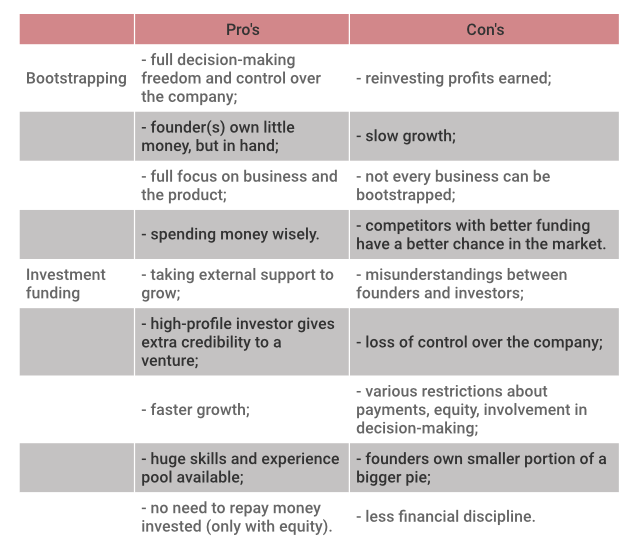

Which path to take: the pros and cons of bootstrapping and investment funding

Now it’s time to only shortlist all the advantages and drawbacks of both financing strategies for your startup idea or any other business. Afterward, I will leave you with this food for thought and study so that you make up your mind and definitely go for your dream!

Best of luck and happy crafting new businesses, guys!

Want to receive reading suggestions once a month?

Subscribe to our newsletters