When you’ve chosen your e-commerce platform, it’s time to determine the payment system to integrate into your business model. We’ve prepared a guide for payment gateway comparison, which we hope you’ll find helpful. And you can solve for yourself the “eternal” question: Paypal vs. Square?

Our lives are bound and defined by our buying ability. And this demands a variety of payment options in the quest for performing a purchase. Modern times require the inclusion of every possible opportunity. That’s where it starts getting a bit complicated.

Download free eBook on eCommerce app development

Download nowWhat’s the deal with online payments?

Payment gateways in eCommerce are tricky. They are right in the foundation of any eCommerce platform because there is no other way of performing transactions online unless you’re an underground guerrilla with your payment system at hand (if you are one of them — please contact us). Because of that, you can’t build a successful eCommerce platform without providing a variety of payment options.

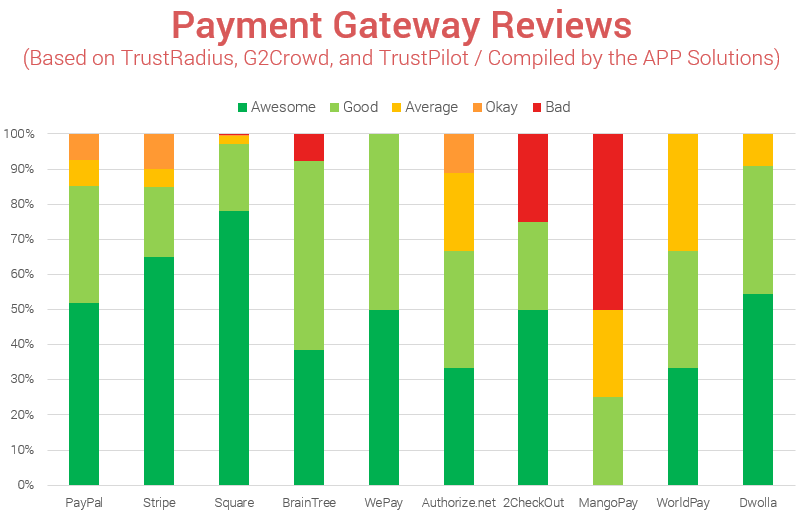

One of the main challenges is that all gateways work differently and various limitations make a particular option more preferable than the others in certain situations.

While some of it depends on the chosen business model, there are still many factors merchants can’t influence. The amount of options is disorienting, and the way various payment gateways present themselves isn’t helping. The fact that there are too many options to choose from and it is hard to tell which are better and why is a challenge for any eCommerce Businessman.

Last year we worked on an eCommerce marketplace (like eBay). It was a big long-running project that offered many challenges to our team. One of them was selecting and implementing various payment systems to cover the broadest possible audience. Our developers and project managers had performed extensive research on the subject, and this is its recreation in a narrative form.

For your consideration — a comparison of the advantages and disadvantages of the top payment systems (Square vs Paypal).

To make things easy to follow, we have chosen to structure the list according to the following structure:

- General Description

- Purpose

- Advantages

- Integration

PayPal Paymenths

If there is one payment system that is arguably the most technologically advanced and at the same time the most accessible — it is probably PayPal. No wonder — it started as an Elon Musk’s startup a long time ago — it couldn’t be anything else.

PayPal payments seems like a standard option for any eCommerce business. Paypal users’ reach immense (aside from a couple of notable exceptions), as is user trust. It is perfect for both general-purpose marketplaces and niche shops.

According to the recent study of Nielsen’s Online Buyer Insights — online stores with PayPal accounts paying option to generate a higher conversion rate than those who don’t — the number goes up to a staggering 44%.

To integrate PayPal, one needs to

- Create a business account and PayPal Facilitator account

- Activate Instant Payment Notifications (IPN)

- Set a URL for IPN Listener to create a notification feed to keep track of transaction events as they go

If you would like to integrate PayPal into your website, you’ll need a business bank account (for other in person transactions, you can use a personal one.) PayPal business account fees are quite affordable – for online sales within the US it’s 2.9% + $0.30 per transaction, and for international sales, it’s a 4.4% transaction fee plus a fixed fee based on currency received. Check out the PayPal integration invoice fee as well as other fees on the website.

Website: www.paypal.com

Supported platforms:

- BigCommerce

- Magento

- Spree Commerce

- Shopify

- WooCommerce

Stripe: PayPal Competitor

The issue users are most concerned about is security. Stripe was designed to hush their worries and offered several innovative solutions to monetary transactions. According to G2Crowd payment gateway research, Stripe is so good at doing its job, it became Paypal’s biggest competitor.

Here’s how it goes: digital transactions go as usual but upon confirming it — the information about the payment passes internal data store and goes straight to secure internal servers the secure servers. There it goes through extensive checks on credibility and fraudulence.

Stripe integration thoroughly documented and is relatively easy to do. Also, it should be noted that Customer support is extremely responsive.

By the way, Stripe, as well as PayPal, make great process payments of mobile gateways.

In terms of fees, Stripe’s credit card processing fee is 2.9% + 30¢, international fees add another 1% on top, and there are also other payment methods.

Website: stripe.com

Supported platforms:

- Bigcommerce

- Shopify

- WooCommerce

- Magento

- Spree Commerce

Square

Square app (formerly known as SquareUp) is a bit player in comparison with the other payment systems, but it compensates its lack of reach by very flexible customization of API and a wide variety of available types of online payments. It is also a perfect choice if you need to make a custom solution.

Square’s most significant advantage is that it provides very flexible payment customization. It is also very comfortable for medium-scale employee management. Another great thing is thorough reporting that gives you a very clear big picture of what is going on with the online payments in the store.

Square Point of Sale app is a very flexible tool for small-scale payment operations, which makes it a convenient WooCommerce payment gateway (since often, WordPress’s e-commerce platform doesn’t need huge online transactions). In the meantime, Square for Retail provides a full set of tools for large-scale payments.

Website: squareup.com

Supported platforms:

- WooCommerce

- Magento

- BigCommerce

- OpenCart

Braintree

User reach and security are not end all be all priorities for the payment system. Sometimes eCommerce platform needs more functional diversity, and that is what Braintree is more than capable to do.

Braintree is part of PayPal, but it offers a slightly different experience. Aside from standard contactless payments — it also accepts from a variety of digital wallets (including but not limiting to Venmo, Coinbase, Google Pay, Apple Pay).

Braintree provides a thoroughly written API that makes integration an easy task for any online store.

One of the main advantages of Braintree — instant separate transfer. Single checkout with multiple items in a cart from different sellers.

Website: braintreepayments.com

Supported platforms:

- Bigcommerce

- Magento

- Spree Commerce

- WooCommerce

- Shopify

WePay

What is WePay? WePay is one of those payment systems that offer more of the same features but in a more refined and elaborate form. Its main difference from PayPal is that WePay does the same thing without messing around. Unlike PayPal transactions which involve redirects to a third-party site — WePay keeps all in the house (something that costs additional 10-$35 on PayPal).

In many ways, WePay is perfect for smaller-sized businesses and crowdfunding campaigns. It is also a go for general purpose online-based transactions. In the case of increased money flow — it becomes increasingly clumsy.

In terms of integration, WePay is probably the most flexible of all reviewed payment systems. The API is well-written and fits like a glove on any online store.

Website: wepay.com

Supported platforms:

- BigCommerce

- Magento

- Spree Commerce

- Shopify

- WooCommerce

Authorize.Net

If there is one contender for an old-school electronic payment system — then it is Authorize.Net. It also allows merchants to use third-party platforms for incoming payments with lowered fees.

Its advantage is simplicity. Authorize.net is miles easier to master the likes of PayPal and Stripe. It takes just a couple of clicks to set up the right threads with the eCommerce platform.

Authorize.net is compatible with every universal shopping system.

Website: authorize.net

Supported platforms:

2CheckOut

2CheckOut is a twofold service. It can act both as the payment gateway and merchant account. From the usability standpoint — it is probably the easiest to use — you need to register, verify your account, and you can start accepting payments.

2CheckOut’s advantage is the number of options available for the user — you can customize the subscription plan to minuscule detail, you can make your in-site checkouts.

The most exciting thing is demo mode where you can test out customer’s buying experience with a variety of settings. This thing can seriously help refine the user experience.

2CheckOut provides a simple API that embeds payment processing right into your site.

Website: 2checkout.com

Supported platforms:

MangoPay

MangoPay is a payment system designed explicitly for eCommerce marketplaces and crowdfunding platforms. Its biggest advantage over the other payment system is a dashboard with an intuitive interface that makes the handling of transactions seem like a no big deal.

MangoPay offers a variety of options that allows merchants to set up automatic payouts through an electronic wallet for every participant of the process — from sellers to buyers. It also uses Know Your Customer processes and anti-money laundering checks.

Because of its customization features, it fits best for international markets.

Website: mangopay.com

Supported platforms:

- BigCommerce

- Magento

- Spree Commerce

- Shopify

- WooCommerce

WorldPay

Since the United Kingdom is a bit of an “an-sich” lately it is reasonable to add a payment solutions specifically for that country. WorldPay is a UK-based service that provides fast and safe transaction on standard fees. It offers a wide variety of paying options adapted to different countries and specifically for the UK.

One of its primary advantages is automated billing and card updates, customizable loyalty cards, etc.

Another essential element is the option of expert advice and personalized reporting. It is also helpful that there is a whole lot of useful information on their blog.

As for integration — it is all simple and fits every primary shopping system.

Website: worldpay.com

Supported platforms:

- BigCommerce

- Magento

- Spree Commerce

- Shopify

- WooCommerce

Dwolla

Dwolla is a fast-growing payment gateway service designed to make bank transfers smoother and more comfortable to digest. And it manages to do that through a nice and easy API with numerous features and an even more satisfying user experience via the dynamic interface.

Among other goodies, Dwolla has to offer are flexible customer management and proper account verification. Many features allow multi-layered sequences of payments and invoicing.

Overall, it is a good fit for enterprises of large scale, medium and small business owners.

Website: dwolla.com

Supported platforms:

- Shopify

- Magento

- BigCommerce

When you’ve read about the most popular gateways it’s time to check out our guide on app payment system integration.

Want to Learn More About The APP Solutions Approaches In Project Development?

Download Free EbookIn Conclusion

We love to shop – whether it’s for groceries or clothes or technology – and the purchasing ability, as well as the availability of buying options, makes this process even more enjoyable.

Besides the offline stores and window-shopping experiences, people shop online more and more and this is why online payment services matter so much.

While it might look as if there are way too many options for an e-store owner, each gateway and platform has its own pros and cons. In case you need help with narrowing down the options, we have done extensive research about them and can help.

We hope this comparison will be helpful to those who want to understand which payment system is a better fit for their eCommerce marketplace.

Want to receive reading suggestions once a month?

Subscribe to our newsletters